Challenge

During 2020, Covid-19 caused tremendous disruption for our clients, a primary example of which was largescale restrictions on branch access. For example, though 90% of openings still take place in a branch, we did see an increase in the percentage of online openings to approximately 10% of openings.

Our clients, curious about the role of traditional branches moving forward, asked if we’ve seen similar trends develop for other self-service options such as online banking and mobile banking. Did Covid-19 influence consumers to more frequently sign up for these services? And if so, have those patterns continued as we’ve moved beyond the pandemic?

Solution

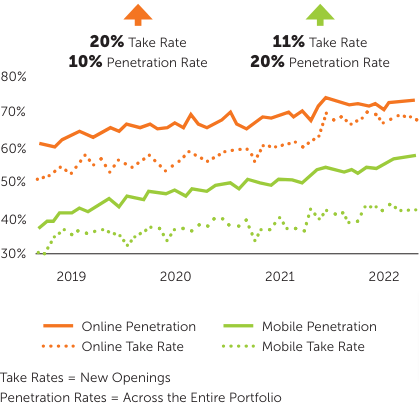

Looking at the data, we see monthly take rates have risen consistently during the prior 48 months for online banking, moving from about 50% in January 2019 to nearly 70% in December 2022. Increasing online banking take rates have driven up the penetration rate from approximately 60% to just over 70% during the same timeframe.

And mobile banking? Monthly take rates have increased from 31% to just over 42% since January of 2019. The mobile banking penetration rate has increased from 37% to 57% from the beginning of 2019 to the end of 2022.

Results

So while the pandemic didn’t create a notable acceleration, the utilization of online and mobile banking continues at a steady pace.

Improvement Overview