By leveraging data from our wide portfolio of clients and the industry at large, we continually identify key trends across all facets of banking. That data informs our High Performance Growth™ strategy and its focus on acquiring checking account relationships.

This is because the checking account constitutes the core relationship between a household and a financial institution. The checking account is also the most common first step toward personal loans, mortgages, savings products, business loans, and all other offerings.

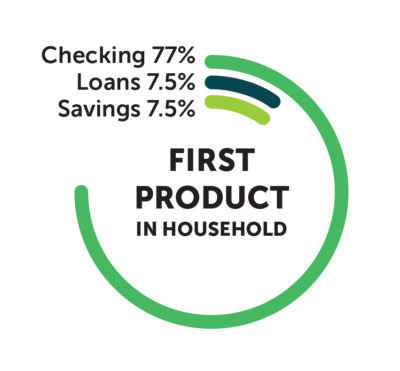

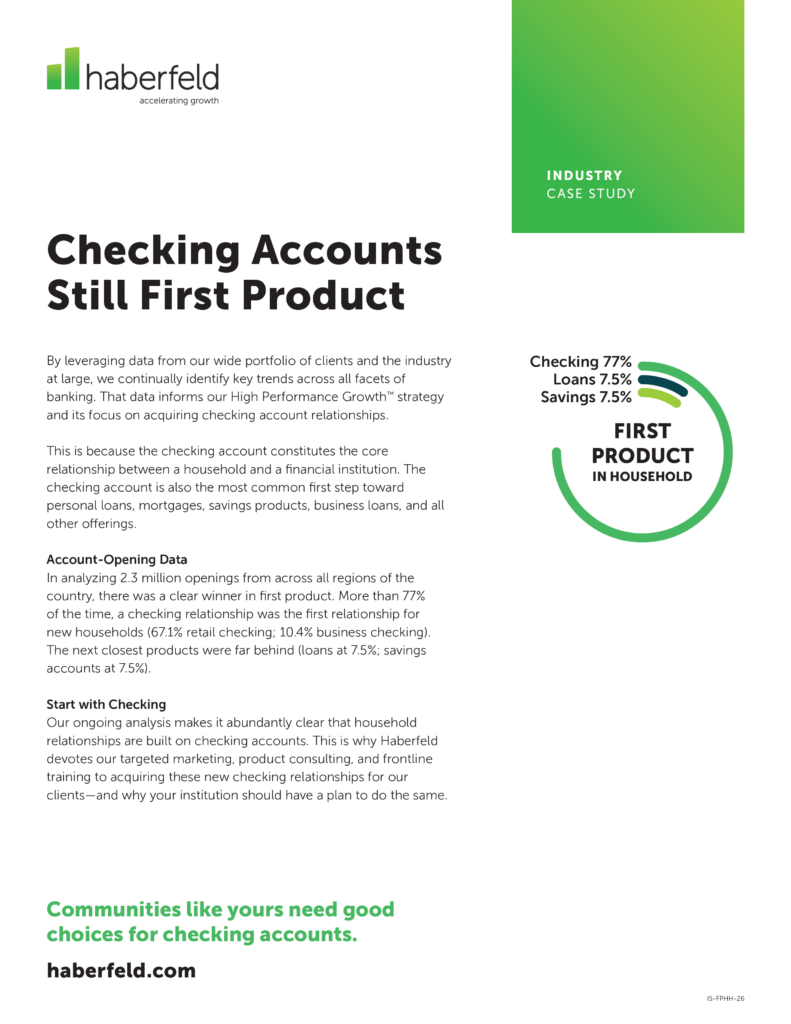

Account-Opening Data

In analyzing 2.3 million openings from across all regions of the country, there was a clear winner in first product. More than 77% of the time, a checking relationship was the first relationship for new households (67.1% retail checking; 10.4% business checking). The next closest products were far behind (loans at 7.5%; savings accounts at 7.5%).

Start with Checking

Our ongoing analysis makes it abundantly clear that household relationships are built on checking accounts. This is why Haberfeld devotes our targeted marketing, product consulting, and frontline training to acquiring these new checking relationships for our clients—and why your institution should have a plan to do the same.